Edge Updates

Dated Brent Report: Focus on the Front

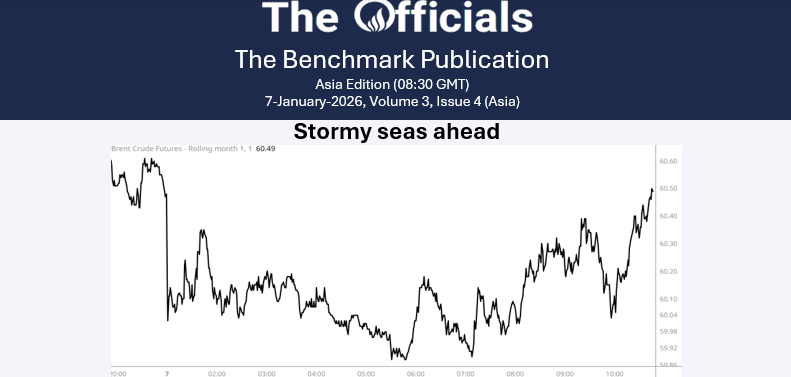

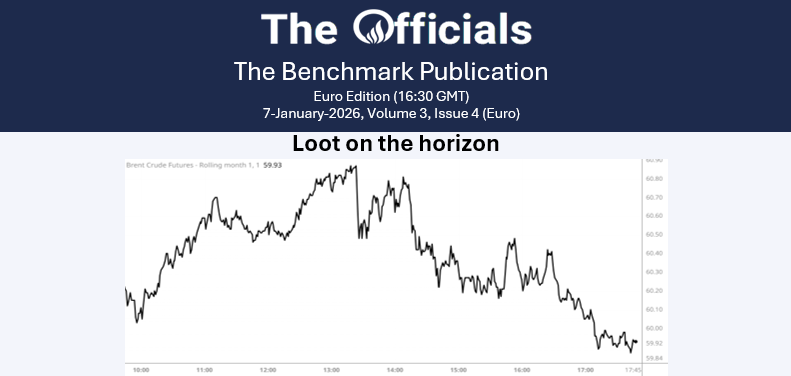

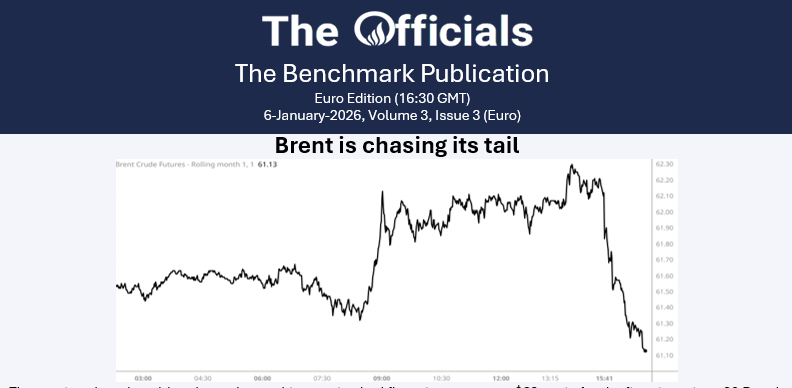

Cargo buying appetite returned to the Dated Brent market in the new year, following a bout of two-way flow to mark the end of the year....

Dubai Market Report: New Year Re-sell-utions

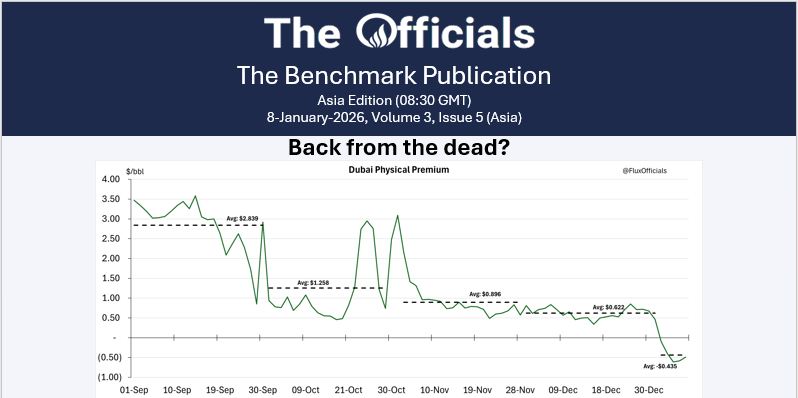

It has been an extremely bearish start to the year for the Dubai crude complex, with the forward curve flirting with contango the entire time. The monthly Dubai spreads have weakened to -10c/bbl at one point, but seems unable to sustain the contango structure. The physical has been very weak, with the physical premium sinking to -61c/bbl, following Saudi Aramco cutting OSPs to Asia, which was for the third consecutive month. Over Christmas, we saw screen buying of Brent/Dubai, especially during weaker physical windows. The Bal-Jan'26 Brent/Dubai has moved up to $1.70/bbl, while Feb'26 has surpassed $0.80/bbl. The only real sellers include Chinese players, and it was well bid by trade houses and majors. At higher levels, we saw producer selling and profit taking on screen. Meanwhile, the Bal-Jan/Feb'26 Dubai spread saw heavy selling interest from trade houses, falling from around -$0.05 to -$0.50/bbl since the new year. For the prompt, the typical pattern is Dubai spreads being sold off in the mornings, then being bid on screen and ending the trading day around flat, so price action has been fairly volatile.

Latest News

Edge Updates

Dated Brent Report: Focus on the Front

Cargo buying appetite returned to the Dated Brent market in the new year, following a bout of two-way flow to mark the end of the year....

Dubai Market Report: New Year Re-sell-utions

It has been an extremely bearish start to the year for the Dubai crude complex, with the forward curve flirting with contango the entire time. The monthly Dubai spreads have weakened to -10c/bbl at one point, but seems unable to sustain the contango structure. The physical has been very weak, with the physical premium sinking to -61c/bbl, following Saudi Aramco cutting OSPs to Asia, which was for the third consecutive month. Over Christmas, we saw screen buying of Brent/Dubai, especially during weaker physical windows. The Bal-Jan'26 Brent/Dubai has moved up to $1.70/bbl, while Feb'26 has surpassed $0.80/bbl. The only real sellers include Chinese players, and it was well bid by trade houses and majors. At higher levels, we saw producer selling and profit taking on screen. Meanwhile, the Bal-Jan/Feb'26 Dubai spread saw heavy selling interest from trade houses, falling from around -$0.05 to -$0.50/bbl since the new year. For the prompt, the typical pattern is Dubai spreads being sold off in the mornings, then being bid on screen and ending the trading day around flat, so price action has been fairly volatile.

Free Dashboards

Free Onyx Insights

Free Onyx Officials

Latest News

Fuel Oil Report: Super Sour

US EIA Weekly Report