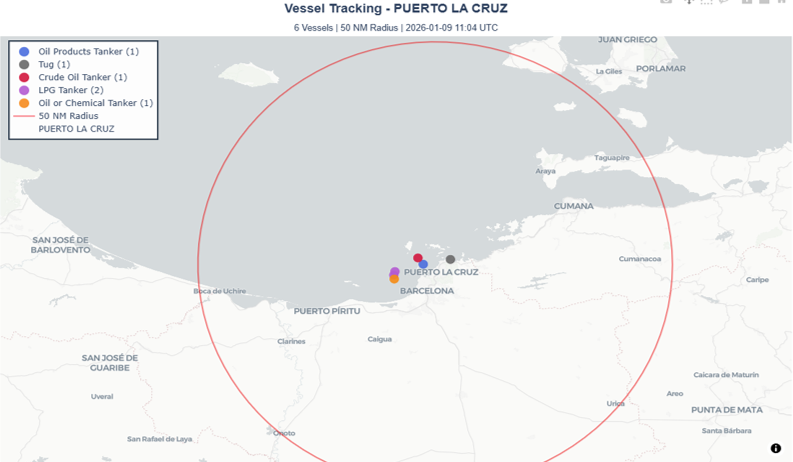

Precious metals up further, continuing rebound after sharp sell off. Silver is already up 2.5% on the day trading near $79/oz and approaching its ATH of $81.80/oz again. That’s 9% higher since the US captured President Maduro on Saturday! But there are concerns among metals traders about further US actions in Latin America impacting supply chain.

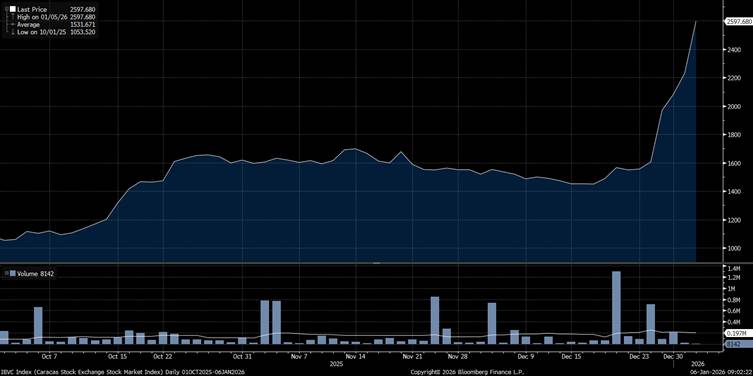

Elsewhere, the market enjoyed the news regarding Venezuela. Venezuelan bonds rallied as investors aggressively repriced the once-remote prospect of regime change and debt restructuring. Defaulted sovereign and PDVSA bonds have already more than doubled to roughly 23–33 cents on the dollar, and distressed investors now see potential recovery values rising toward 50–60 cents if a credible political transition takes hold. In stocks, yesterday, Venezuela’s Caracas Stock Exchange ended the day nearly +17% higher! (Chart 1, Bloomberg)

Markets are brushing off geopolitics and leaning risk-on. US Treasuries are weaker with yields +1–2.5bp across the curve (10Y 4.17%, near top of the 4.11–4.19% range). The USD is softer with the DXY trading at 98.26 following Monday’s ISM miss, while equities and commodities stay bid.

US Manufacturing remains under pressure – ISM has been in contraction for 10 months while markets remain focused on US labour data this week (ADP Wed, NFP Fri). Trump signalled the US may reimburse oil companies investing in Venezuela, reinforcing expectations of state-backed energy intervention.

UK food inflation ticked up again (BRC shop prices +0.7% y/y vs 0.6% prior), adding pressure to real incomes.

And for France things are really uncomfortable as inflation came in December at just 0.8% y/y. The second-largest economy in the eurozone is now running well below target. Not good news for the ECB – the market is currently pricing a just 3bps for the November 6 meeting, but if other countries follow, bets should ramp up.

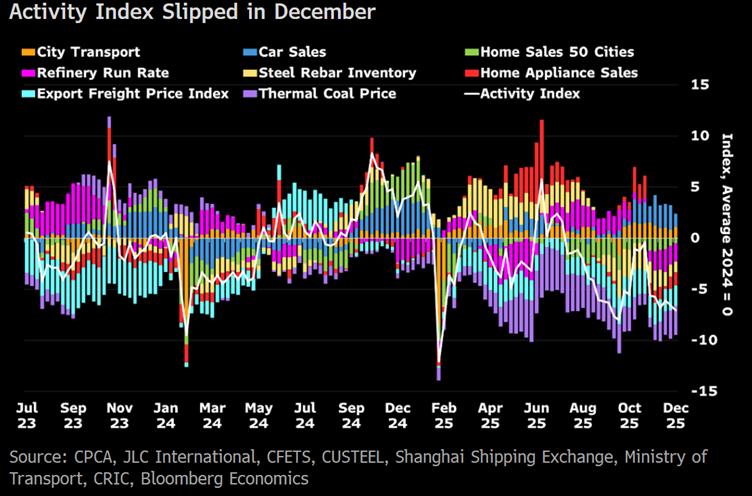

December’s rebound in China’s official PMIs may be short lived according to Bloomberg Economics. High-frequency data point to continued weakness, with the activity index falling to -7.1 in late December, the second-lowest since February. The drag is demand-led: new-home sales plunged 41% y/y, appliance sales fell 34%, and car sales dropped 17%. Production indicators remain soft rather than improving, reinforcing the view that the PMI bounce reflects stabilisation at low levels, not a genuine economic turnaround. (Chart 2, Bloomberg)

India HSBC Services PMI for December revised down hard in final estimate, from 59.1 in preliminary estimate to 58, still showing strong growth but the lowest mark since January 2025. Rupee weakens to over 90 to USD again after Indian central bank attempted to strengthen it, highest point is just over 91…

Data today: German inflation, US Redbook