Silver is down hard this morning, trading 3% lower on the day, as traders are realising the profits following those extreme moves seen recently (Figure 1, TradingView).

Precious metals are losing momentum – gold is also down 0.5% on the day.

Venezuela’s state-owned oil company PDVSA says it’s in talks with the US for the sale of oil to benefit both sides. The talks are “within the framework of the trade relationship between the two countries,” it says. Surprisingly, no mention of President Maduro. Trump announced yesterday that Venezuela will “be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal.”

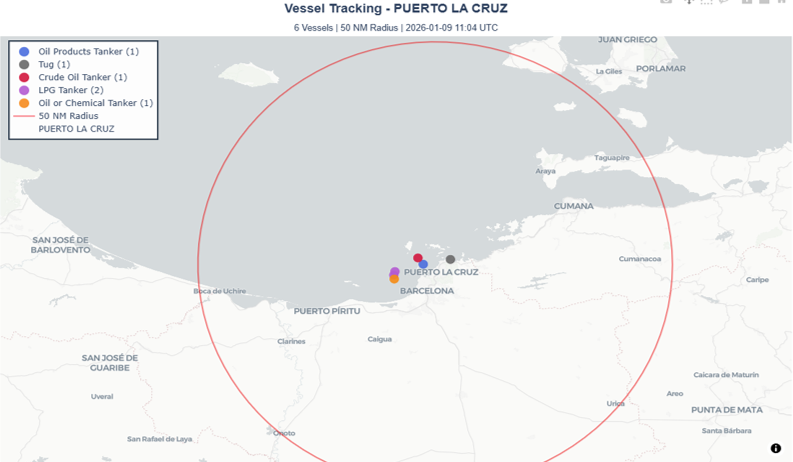

The US seized two tankers yesterday: the first one was M SOPHIA (IMO: 9289477), a US-sanctioned VLCC super tanker laden with 1.8 million barrels of Venezuelan crude oil. M SOPHIA had been often operating under the false identity VARADA BLESSING (IMO 9039626), a so-called “zombie” vessel. In addition, US-sanctioned MARINERA (9230880, fka BELLA 1) was seized yesterday near Scotland as it was heading to Russia – a VLCC supertanker not carrying any oil. Russia called the US seizure of Marinera illegal, but there’s been no further action from them.

Demand for compliant vessels surged yesterday, Frontline stock surged 8.47%, Hunter Group share jumped 13%, while Breakwave Tanker Shipping stock surged nearly 15% on the day!

Over in the US, at least $17 billion was wiped from Blackstone’s share price within minutes yesterday after Trump announced he is banning single-family home purchases for institutional investors. (Figure 2, Kobeissi Letter). For institutions, this is detrimental news, after all, as the share of investor purchases of single-family houses is now at 27%! Large investors are the least affected ones – just 3% as a share of investor purchases – while small and medium investors account for almost 85% of the investors’ purchases.

Now, Trump announced that he wants to increase the military budget from $901 billion to $1.5 trillion by 2027 to build his “Dream Military”, that’s a 66% increase. How is all this money going to be financed? More debt – but the US currently has a debt approaching to $38.6 trillion or something over 124% of GDP. Defence stocks rose with the news, with Lockheed Martin trading over 6.2% higher in the afterhours and General Dynamics surged as much as 4.4%.

Data today – Euro Area Unemployment Rate, PPI, Economic Sentiment, US Balance of Trade, Initial Jobless Claims, Japan Household Spending