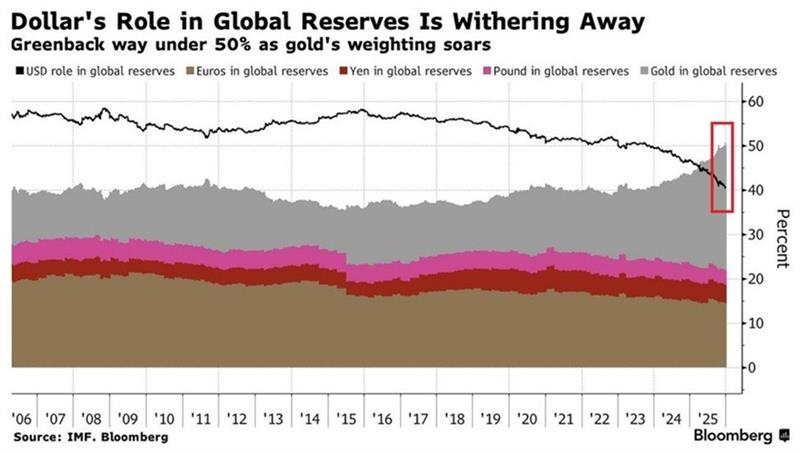

As gold prices have gone to the moon, now trading just below $4.5k/oz, central banks are showing big gains. The Swiss National Bank posted a $33bn profit in 2025, driven overwhelmingly by a surge in gold prices. Gold rallied roughly 65% last year, its strongest annual gain since 1979, more than offsetting losses on foreign currency positions caused by a stronger franc.

The move reflects a deeper trend: the US dollar’s share of global FX reserves has fallen to around 40%, the lowest in at least two decades – down 18% over the last 10 years! Over the same period, gold’s share has climbed to 28%, now exceeding the combined reserves held in euros, yen and pounds (Figure 1). As central banks continue diversifying away from the dollar and aggressively stockpiling gold, the metal is reasserting itself as a core anchor of the global monetary system.

Trump instructs ‘representatives’ to buy $200 billion in mortgage bonds, hoping to bring down rates and monthly payments. A source at a federally backed mortgage agency is concerned this means the market will “rip us off”.

Trump suggests land military operations in Mexico could begin against drug cartels that ‘running’ the country.

At least he must be happy the US trade deficit contracted to $29.4bn in October, down from $48.1bn. That’s the lowest since 2009, largely thanks to front-loading of imports in September. Imports fell, especially of pharmaceuticals. But trade talks with India stalled because Modi didn’t call Trump, according to Lutnick.

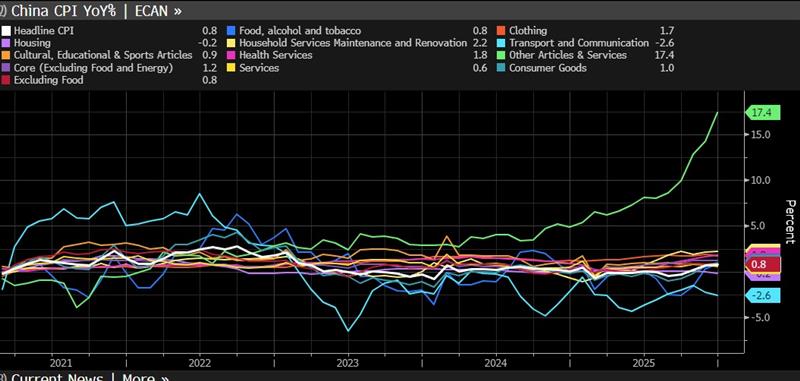

Chinese inflation shows mixed picture: December PPI was -1.9%, but less deflationary than November (-2.2%) and above expectations of -2%. Meanwhile, CPI increased to 0.8% y/y (Figure 2), rising from 0.7% in November but below expectations of 0.9%. The rise was driven by food prices, particularly fresh fruit and vegetables. Housing prices resume their fall, though, down 0.2% after being flat in November. Core inflation (ex food and energy) held steady at 1.2%, its highest in 20 months.

Data today: Dec NFPs, Mich consumer sentiment, building permits and housing starts