Latest

Market chatter from the Flux News team – a bitesize summary of global economic news.

Get the latest headlines on the Flux News channel

Stay up to date with energy market headlines on our newly launched news channel

Central Bank Gains, Chinese Inflation, Housing Prices Resume Their Fall

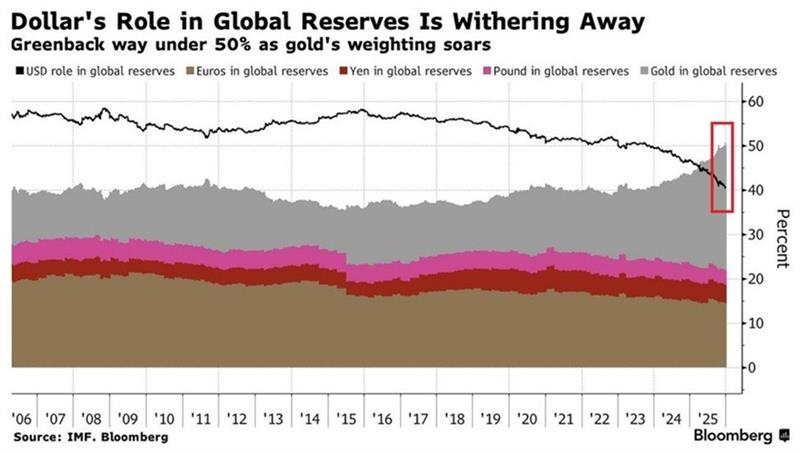

As gold prices have gone to the moon, now trading just below $4.5k/oz, central banks are showing big gains. The Swiss National Bank posted a $33bn profit in 2025, driven overwhelmingly by a surge in gold prices. Gold rallied roughly 65% last year, its strongest annual gain since 1979, more than offsetting losses on foreign currency positions caused by a stronger franc.

The move reflects a deeper trend: the US dollar’s share of global FX reserves has fallen to around 40%, the lowest in at least two decades – down 18% over the last 10 years! Over the same period, gold’s share has climbed to 28%, now exceeding the combined reserves held in euros, yen and pounds (Figure 1). As central banks continue diversifying away from the dollar and aggressively stockpiling gold, the metal is reasserting itself as a core anchor of the global monetary system.

Trump instructs ‘representatives’ to buy $200 billion in mortgage bonds, hoping to bring down rates and monthly payments. A source at a federally backed mortgage agency is concerned this means the market will “rip us off”.

Trump suggests land military operations in Mexico could begin against drug cartels that ‘running’ the country.

At least he must be happy the US trade deficit contracted to $29.4bn in October, down from $48.1bn. That’s the lowest since 2009, largely thanks to front-loading of imports in September. Imports fell, especially of pharmaceuticals. But trade talks with India stalled because Modi didn’t call Trump, according to Lutnick.

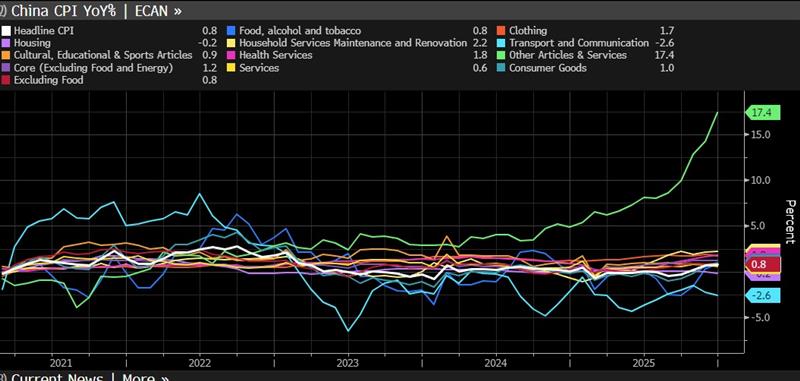

Chinese inflation shows mixed picture: December PPI was -1.9%, but less deflationary than November (-2.2%) and above expectations of -2%. Meanwhile, CPI increased to 0.8% y/y (Figure 2), rising from 0.7% in November but below expectations of 0.9%. The rise was driven by food prices, particularly fresh fruit and vegetables. Housing prices resume their fall, though, down 0.2% after being flat in November. Core inflation (ex food and energy) held steady at 1.2%, its highest in 20 months.

Data today: Dec NFPs, Mich consumer sentiment, building permits and housing starts

Silver Down, PDVSA In Talks with US, $17bn Erased from Blackstone Shares, Trump Announces ‘Dream Military’

Silver is down hard this morning, trading 3% lower on the day, as traders are realising the profits following those extreme moves seen recently (Figure 1, TradingView).

Precious metals are losing momentum – gold is also down 0.5% on the day.

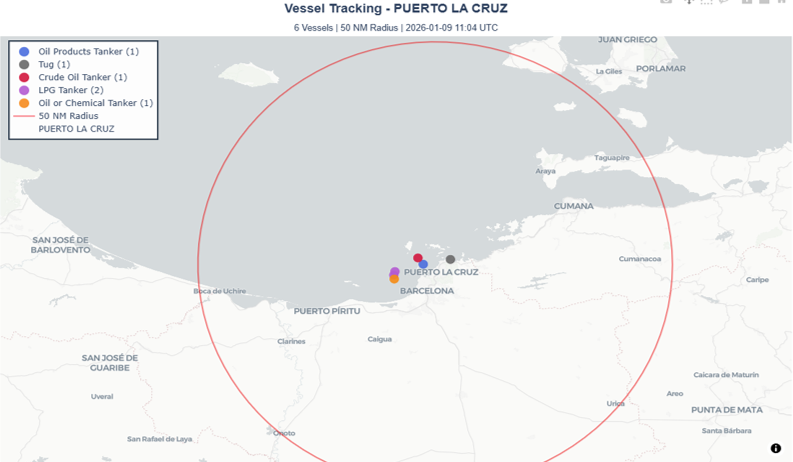

Venezuela’s state-owned oil company PDVSA says it’s in talks with the US for the sale of oil to benefit both sides. The talks are “within the framework of the trade relationship between the two countries,” it says. Surprisingly, no mention of President Maduro. Trump announced yesterday that Venezuela will “be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal.”

The US seized two tankers yesterday: the first one was M SOPHIA (IMO: 9289477), a US-sanctioned VLCC super tanker laden with 1.8 million barrels of Venezuelan crude oil. M SOPHIA had been often operating under the false identity VARADA BLESSING (IMO 9039626), a so-called “zombie” vessel. In addition, US-sanctioned MARINERA (9230880, fka BELLA 1) was seized yesterday near Scotland as it was heading to Russia – a VLCC supertanker not carrying any oil. Russia called the US seizure of Marinera illegal, but there’s been no further action from them.

Demand for compliant vessels surged yesterday, Frontline stock surged 8.47%, Hunter Group share jumped 13%, while Breakwave Tanker Shipping stock surged nearly 15% on the day!

Over in the US, at least $17 billion was wiped from Blackstone’s share price within minutes yesterday after Trump announced he is banning single-family home purchases for institutional investors. (Figure 2, Kobeissi Letter). For institutions, this is detrimental news, after all, as the share of investor purchases of single-family houses is now at 27%! Large investors are the least affected ones – just 3% as a share of investor purchases – while small and medium investors account for almost 85% of the investors’ purchases.

Now, Trump announced that he wants to increase the military budget from $901 billion to $1.5 trillion by 2027 to build his “Dream Military”, that’s a 66% increase. How is all this money going to be financed? More debt – but the US currently has a debt approaching to $38.6 trillion or something over 124% of GDP. Defence stocks rose with the news, with Lockheed Martin trading over 6.2% higher in the afterhours and General Dynamics surged as much as 4.4%.

Data today – Euro Area Unemployment Rate, PPI, Economic Sentiment, US Balance of Trade, Initial Jobless Claims, Japan Household Spending

Oil Resumes Sell-Off, US Treasuries Modestly Firmer, PBOC Shares in Chinese Government Bond Holdings

Markets open with risk sentiment fraying at the edges as oil resumes its sell-off. Crude is under pressure after President Trump said Venezuela will “turn over” 30–50mn barrels of oil to the US. WTI is down 1.6% to $56.2/bbl, Brent -1.1% to $60.0, reinforcing surplus fears after Tuesday’s 2% drop.

US Treasuries are modestly firmer ahead of key data. The 10Y is down 1.6bp at 4.157%, curve gently flattening, as the recent steepener in the treasuries curve loses steam. AUD is the standout, jumping to 0.6760, fresh 2024 highs, after Australia’s November CPI undershot expectations (3.4% y/y vs 3.6% est; trimmed mean 3.2%). RBA hike odds for 2026 edged higher.

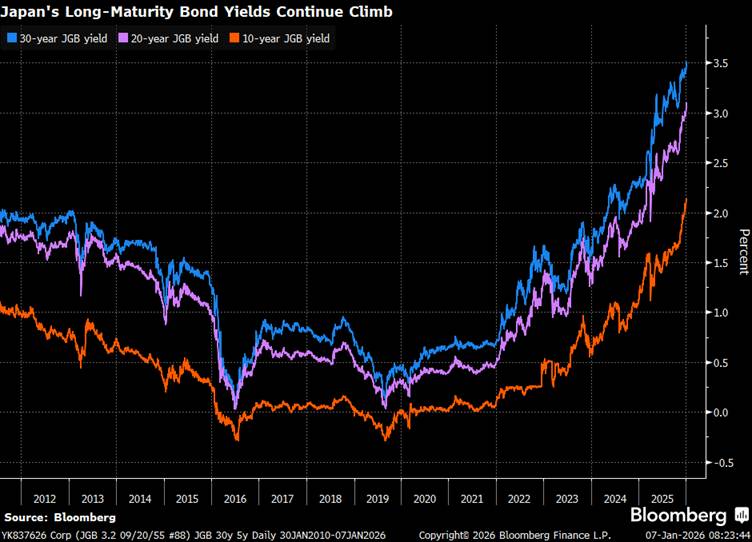

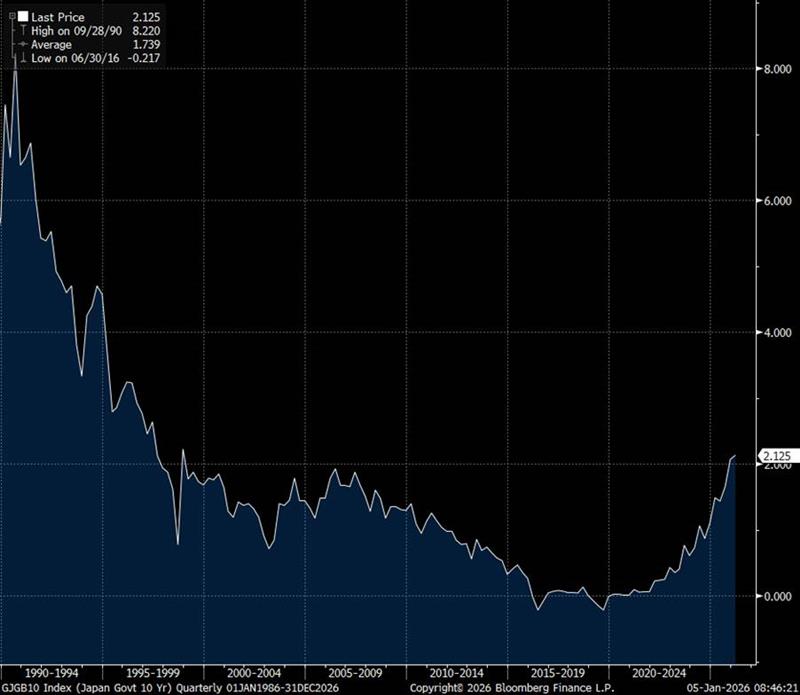

Risk-off flows nudged Japan markets: USD/JPY -0.1% to 156.54, JGB futures +16 ticks to 132.16 as stocks fell on rising China–Japan tensions. China’s export controls could hit 40%+ of shipments by one estimate. Long-end stress persists: 20Y highest since 1999, 30Y at record highs (Figure 1, Bloomberg)

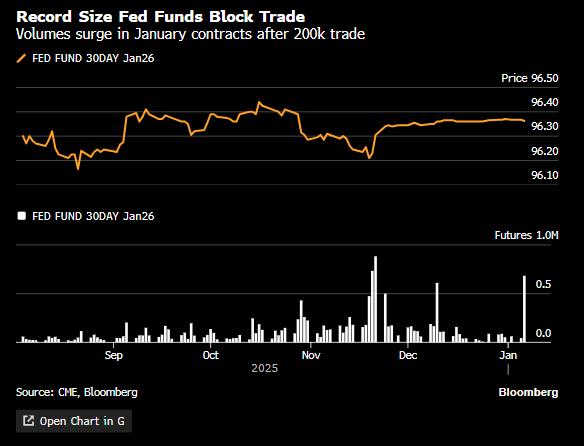

A record 200,000-lot block went through in the Jan fed funds futures contract (CME’s biggest ever), as one trader could be betting big on overpriced near-term cuts and that policy stays restrictive into late January (Figure 2, Bloomberg). That said open interest fell by ~111,000 on the day so could also likely be a simple a cleanup/unwind of an existing position than a brand-new mega-sized hawkish bet.

The PBOC’s share of China Government Bond holdings likely have ticked up to ~5.5% in November, the first rise since it halted net CGB buying in Jan 2025 (and resumed in October). It reported CNY50bn of net CGB purchases in November, broadly matching the CNY48.8bn rise in CGB holdings on its balance sheet – potentially a template for supporting heavier 2026 supply.

Data today: ADPs, JOLTs, ISM Services, Euro inflation, German retail sales

Venezuelan Bonds Rally, US Treasuries, Chinese PMI

Precious metals up further, continuing rebound after sharp sell off. Silver is already up 2.5% on the day trading near $79/oz and approaching its ATH of $81.80/oz again. That’s 9% higher since the US captured President Maduro on Saturday! But there are concerns among metals traders about further US actions in Latin America impacting supply chain.

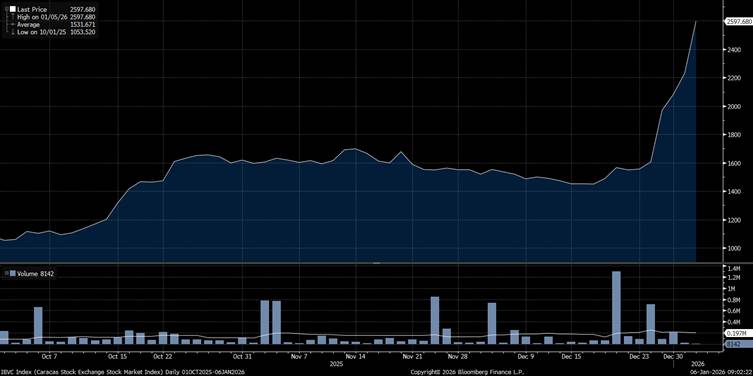

Elsewhere, the market enjoyed the news regarding Venezuela. Venezuelan bonds rallied as investors aggressively repriced the once-remote prospect of regime change and debt restructuring. Defaulted sovereign and PDVSA bonds have already more than doubled to roughly 23–33 cents on the dollar, and distressed investors now see potential recovery values rising toward 50–60 cents if a credible political transition takes hold. In stocks, yesterday, Venezuela’s Caracas Stock Exchange ended the day nearly +17% higher! (Chart 1, Bloomberg)

Markets are brushing off geopolitics and leaning risk-on. US Treasuries are weaker with yields +1–2.5bp across the curve (10Y 4.17%, near top of the 4.11–4.19% range). The USD is softer with the DXY trading at 98.26 following Monday’s ISM miss, while equities and commodities stay bid.

US Manufacturing remains under pressure – ISM has been in contraction for 10 months while markets remain focused on US labour data this week (ADP Wed, NFP Fri). Trump signalled the US may reimburse oil companies investing in Venezuela, reinforcing expectations of state-backed energy intervention.

UK food inflation ticked up again (BRC shop prices +0.7% y/y vs 0.6% prior), adding pressure to real incomes.

And for France things are really uncomfortable as inflation came in December at just 0.8% y/y. The second-largest economy in the eurozone is now running well below target. Not good news for the ECB – the market is currently pricing a just 3bps for the November 6 meeting, but if other countries follow, bets should ramp up.

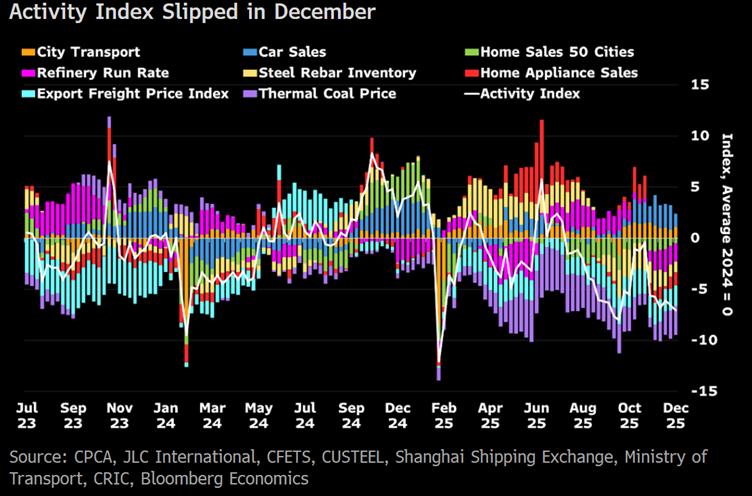

December’s rebound in China’s official PMIs may be short lived according to Bloomberg Economics. High-frequency data point to continued weakness, with the activity index falling to -7.1 in late December, the second-lowest since February. The drag is demand-led: new-home sales plunged 41% y/y, appliance sales fell 34%, and car sales dropped 17%. Production indicators remain soft rather than improving, reinforcing the view that the PMI bounce reflects stabilisation at low levels, not a genuine economic turnaround. (Chart 2, Bloomberg)

India HSBC Services PMI for December revised down hard in final estimate, from 59.1 in preliminary estimate to 58, still showing strong growth but the lowest mark since January 2025. Rupee weakens to over 90 to USD again after Indian central bank attempted to strengthen it, highest point is just over 91…

Data today: German inflation, US Redbook

Precious Metals Bounce, Chevron Jumps, China & Japan’s PMI, Crypto Rally?

Precious metals bounce again, gold up 2.3% this morning, silver up over 4%. Other safe haven assets, including Swiss Franc and sovereign debt did not react, with a rather muted reaction. Copper is climbing too, as COMEX copper approaches its late-July highs above $5.80/lb. Key resistance around $5.90/lb.

Chevron stock jumped 2.3% on Friday (Figure 1), in advance of the US attack on Venezuela – watch what it does today!

China’s non-official RatingDog PMI for December showed solid expansion in both services (52) and composite measures (53.1). Japan’s manufacturing PMI was revised up for December to 50, above market expectations of 49.7, just about breaking even.

Asia shows sharp divergence. Japan’s central bank reiterated its intention to keep tightening as inflation improves, pushing JGB yields higher, with the 10-year yield at 2.125%, offering limited support for the yen (Figure 2).

In contrast, China’s PBOC drained liquidity and set a weaker yuan fixing, while authorities doubled down on supporting growth, stabilising property markets and targeting ~5% growth in 2026.

China has kicked off its 2026 national consumption subsidy programme early, signalling policy continuity, but the scale looks smaller than last year. The 1Q26 allocation of CNY62.5bn implies a full-year total of roughly CNY250bn if unchanged, below the CNY300bn rolled out in 2025. That reduction risks a material drag on growth, especially in the first half, compounded by tough base effects from last year’s front-loaded support.

Crypto is showing signs of a rally in January so far, with every day of 2026 green for Bitcoin, which is 5% up from close of December – similar gains for Ethereum.

Data today: US ISM Manufacturing PMI

Precious Metals, Copper, Limited Data

Morning Macro 30th December

Crazy price action in precious metals continues. Gold down more than 4.4% yesterday is the small mover as silver fell over 9%! The aggressive move higher in silver to record high near $84/oz (Figure 1) at yesterday’s market open suggests shorts stopping out, before price collapsed through trading.

Platinum collapsed too, down almost 14.5% and palladium was hit even harder (-15.8% Figure 2). Even non-precious metals have been violent: copper jumped 5% on Friday then fell almost 4.8% yesterday. This morning bounced 2% already.

Elsewhere, limited data at the moment. Currencies have steadied this past week – USD/INR consolidating just below 90, EUR/USD likewise under 1.18 and USD/JPY around 156.

Traders also read...

The Officials: Peering Eye 1.8

Weekly Oil Inventories Report