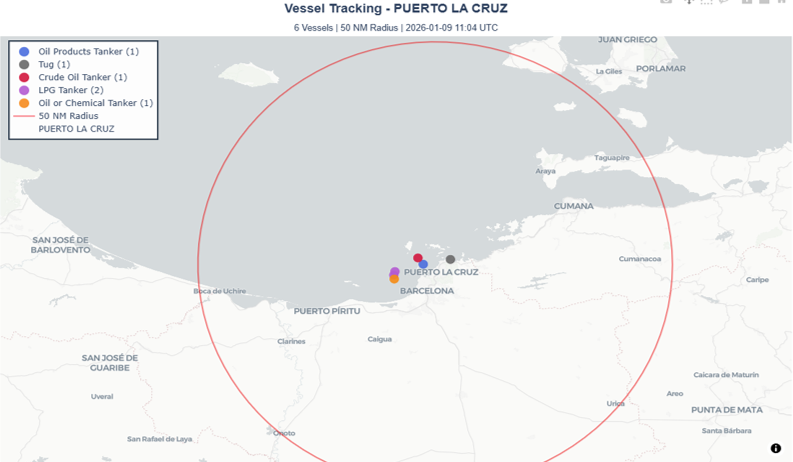

Markets open with risk sentiment fraying at the edges as oil resumes its sell-off. Crude is under pressure after President Trump said Venezuela will “turn over” 30–50mn barrels of oil to the US. WTI is down 1.6% to $56.2/bbl, Brent -1.1% to $60.0, reinforcing surplus fears after Tuesday’s 2% drop.

US Treasuries are modestly firmer ahead of key data. The 10Y is down 1.6bp at 4.157%, curve gently flattening, as the recent steepener in the treasuries curve loses steam. AUD is the standout, jumping to 0.6760, fresh 2024 highs, after Australia’s November CPI undershot expectations (3.4% y/y vs 3.6% est; trimmed mean 3.2%). RBA hike odds for 2026 edged higher.

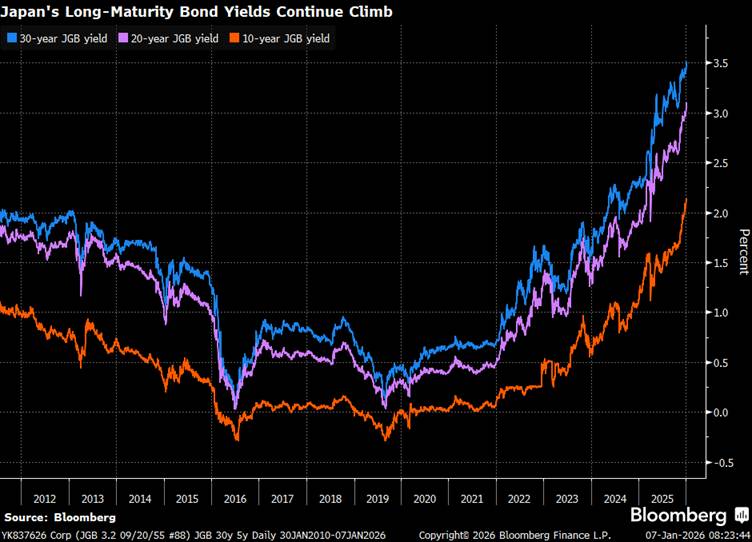

Risk-off flows nudged Japan markets: USD/JPY -0.1% to 156.54, JGB futures +16 ticks to 132.16 as stocks fell on rising China–Japan tensions. China’s export controls could hit 40%+ of shipments by one estimate. Long-end stress persists: 20Y highest since 1999, 30Y at record highs (Figure 1, Bloomberg)

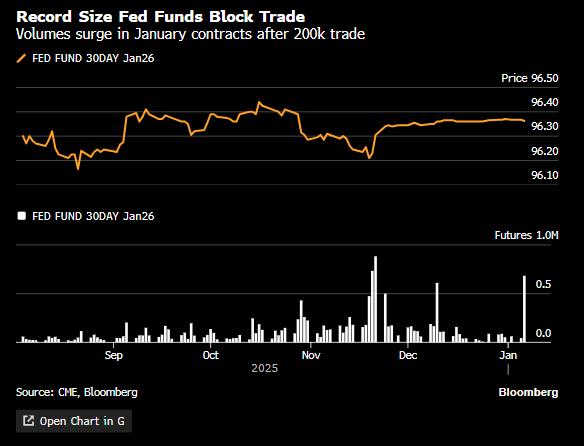

A record 200,000-lot block went through in the Jan fed funds futures contract (CME’s biggest ever), as one trader could be betting big on overpriced near-term cuts and that policy stays restrictive into late January (Figure 2, Bloomberg). That said open interest fell by ~111,000 on the day so could also likely be a simple a cleanup/unwind of an existing position than a brand-new mega-sized hawkish bet.

The PBOC’s share of China Government Bond holdings likely have ticked up to ~5.5% in November, the first rise since it halted net CGB buying in Jan 2025 (and resumed in October). It reported CNY50bn of net CGB purchases in November, broadly matching the CNY48.8bn rise in CGB holdings on its balance sheet – potentially a template for supporting heavier 2026 supply.

Data today: ADPs, JOLTs, ISM Services, Euro inflation, German retail sales