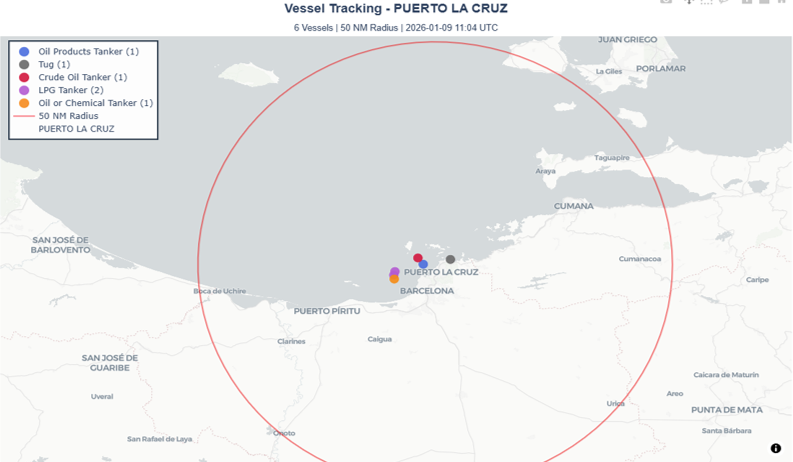

The Mar’26 Brent futures contract gapped up by 34c this morning, opening at $61.10/bbl. Prices initially eased through the early morning, falling to $59.78/bbl at 08:30 GMT before recovering to $60.68/bbl at 10:00 GMT (time of writing). In the news, the US carried out a strike on Venezuela over the weekend on 03 Jan and captured its President, Nicolas Maduro, and First Lady, Cilia Flores. Maduro is set to appear in a New York court today, facing charges that include narco-terrorism conspiracy, cocaine importation conspiracy, and possession of machine guns and destructive devices. Following the operation, US President Trump said that the US would take control of Venezuela and that US oil companies were prepared to rebuild the “badly broken oil infrastructure” and begin “making money for the country.” The White House has also reportedly told US oil companies to engage in this rebuild to receive compensation for assets previously seized by Caracas. According to the Financial Times, Ali Moshiri, a former top Chevron executive, is seeking $2bn for Venezuelan oil projects following the US attack. Moshiri’s investment fund, Amos Global Energy Management, is currently discussing a private placement with institutional investors to initiate investment. In related news, tanker tracking data indicates that about a dozen US-sanctioned tankers carrying Venezuelan crude and fuel have left the country’s waters in dark mode over the past few days, bypassing the US blockade. In other news, OPEC+ has extended its pause on oil output for Q1’26, citing low seasonal demand. The organisation’s meeting on 04 Jan was short, with no statement on the geopolitical developments of its member countries. The group is set to meet next on 01 Feb. Elsewhere, Japan’s Osaka Gas has announced the commercial start of the No.1 unit at its new 1.25-gigawatt gas-backed power station in Himeji. The plant includes two 622.6-megawatt units, with the No.2 unit scheduled to start in May. In macro news, Bank of England data shows that British consumer borrowing has risen by the most in 2 years, reaching £4.5bn in November. Finally, the front-month (Mar/Apr’26) and 6-month (Mar/Sep’26) spreads are at $0.34/bbl and $0.62/bbl, respectively.