View: Bearish

Target Price: $62.5-64/bbl

Government shutdown to momentum shutdown

Volatility is dropping, and M1 Brent futures hit firm resistance on 11 Nov as the contract met the 50-day moving average and downtrend line from late-September.

The contract has continued to follow this line as resistance, as seen on 14 Nov, intraday. There appears to be little indication of strong enough positive momentum to break through this trend line, so the upper bound of the forecast is set accordingly.

- Technical downtrend

- Old data on deaf ears

- Lacklustre changes in positioning

Technical Downtrend

Looking further into the technicals, the price and the lagging line are both below the Ichimoku cloud, indicating a wider bearish trend. The ADX is as low as 13, with the DMI- and DMI+ indicators essentially level, indicating a very weak, directionless market with no clear trend dominance. We expect the path of least resistance to be for the contract to weaken, with the Ichimoku cloud, trendline, and previously robust resistance line of the 50-day moving average overhead.

Old data on deaf ears

The US government is back in action, with an omission of around 60 data points over the hiatus, leading to a pretty opaque view of the health of the US economy. There seems to be a lot of uncertainty surrounding what will be released and when, but we know that this week, the focus is on the jobs report on Thursday.

If this comes out softer than expected, that should boost the chance of a Fed cut in December and aid risk assets. So if these come and firm, there could be a little hope of some Brent support with broader risk on. The considerable asterisk to this, however, is that this is just the NFP from September, and the considerable lag will likely reduce the impact considerably.

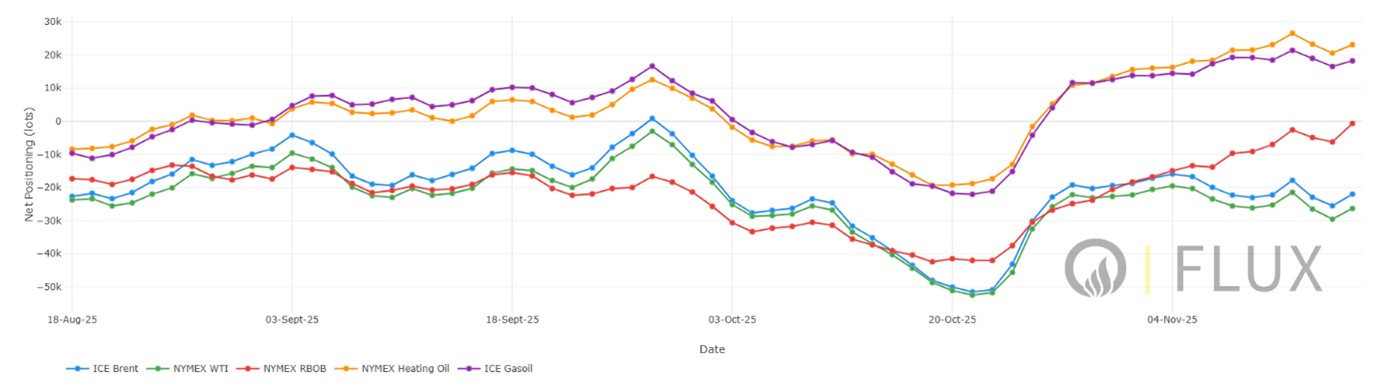

Lacklustre changes in positioning

Positioning failed to provide any clarity or indicate significant changes were brewing. ICE COT data for the week to 11 Nov showed net positioning experiencing the smallest net change in six weeks. Funds removed more short positions than longs, which brought the net positioning to just above average over the past two months.

Flux’s CTA net positioning shows an almost completely flat weekly net change for the Brent. There may be some support from the unabated strength in gasoline and robust gasoil, with European margins at seasonal highs. Fundamentally, the IEA and OPEC’s monthly reports released last week were pretty bleak for bulls, and the addition of 6.41mb of crude to US inventories (est. 1.5mb) in the week to 07 Nov did little to relieve this.